Tax Agency Services

As always, customers grow with you!

What is Value Added Tax (VAT)

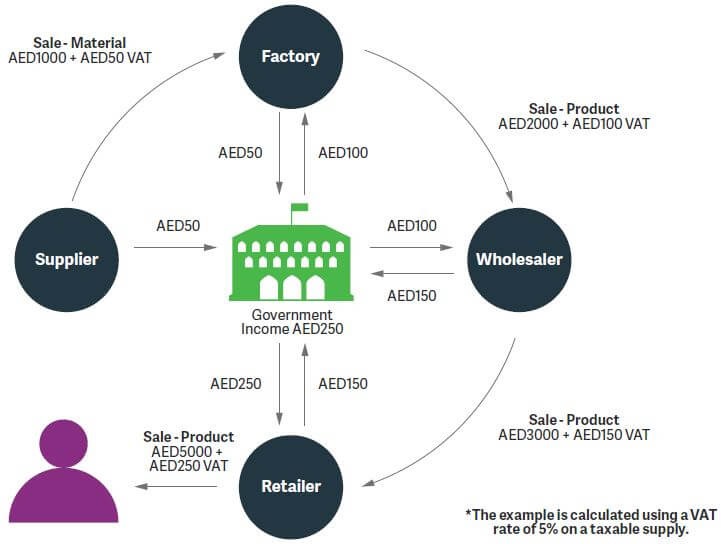

VAT or Value Added Tax is the tax levied on every exchange and is applicable to all activities involved in the production and provisioning of goods and services. VAT returns normally involve the payment due and post deduction of VAT on purchases from the VAT amount charged on the sale.

Our VAT Services

As always, customers grow with you!

If you are not registered for VAT and would like to register for it, we can do that for you. Our service is targeted towards businesses of all sizes.

We help you submit your VAT returns online in a timely manner so that you avoid having to deal with penalties and other liabilities. We always act in your best interest to make sure you do not underpay or overpay your VAT amounts.

Should you need VAT de-registration assistance, we can help with that as well. We can completely de-register you from the VAT scheme.

VAT consultancy assists you to obtain substantial knowledge in VAT and our consultants assure that your business process is totally prepared and skilled for the transition. Over and above the scope of services mentioned above.

What is Excise Tax

Was introduced across the UAE in 2017. Excise tax is a form of indirect tax levied on specific goods which are typically harmful to human health or the environment. These goods are referred to as “excise goods”. When considering whether a product is an excise good, the following definitions apply:

• Carbonated drinks include any aerated beverage except for unflavored aerated water. Also considered to be carbonated drinks are any concentrations, powder, gel, or extracts intended to be made into an aerated beverage.

• Energy drinks include any beverages which are marketed, or sold as an energy drink, and containing stimulant substances that provide mental and physical stimulation, which includes without limitation: caffeine, taurine, ginseng and guarana. This also includes any substance that has an identical or similar effect as the aforementioned substances. Also considered to be energy drinks are any concentrations, powder, gel or extracts intended to be made into an energy enhancing drink.

• Tobacco and tobacco products include all items listed within Schedule 24 of the GCC Common Customs Tariff.

Our Excise Tax Services

As always, customers grow with you!

- Online Registration

- Excise Return Submission

- D.Z Register & Renewals

- Excise De-registration

- Excise Consultancy

If you are not registered for Excise and would like to register for it, we can do that for you. Our service is targeted towards businesses of all sizes.

We help you submit your Excise returns online in a timely manner so that you avoid having to deal with penalties and other liabilities.

If you wish to register Designated Zone or you want to renew, we can do that for you. Our service is targeted towards businesses of all sizes.

Should you need Excise de-registration assistance, we can help with that as well. We can completely de-register you from the VAT scheme.

Consultancy assists you to obtain substantial knowledge in Excise Tax and our consultants assure that your business process is totally prepared and skilled for your assistance any time.